Dental insurance can be a precious resource that allows you to achieve and maintain a healthy smile with minimal financial stress. But what if you are a bit confused about how to get the greatest value out of your policy? You are in good company. Many people have questions about dental insurance. This blog post may clear things up a little. It explores four basic points that you should keep in mind.

Take Advantage of Preventive Services

Dental insurance is designed to encourage preventive care. It usually provides 100% coverage for services like cleanings, exams, and routine X-rays. Your policy may allow you to attend two preventive appointments each year while paying little to nothing out of pocket. On their own, the value of these basic services often meets or exceeds the cost of a dental insurance plan.

Use Your Coverage Before It Expires

Dental insurance typically operates on a calendar-year basis. With standard PPO policies, there is an annual limit on how much your insurance company will pay for approved services each year. Often, the limit is $1,000 or more. At the end of the year, any unused portion of your annual maximum will not roll over. It will simply be gone forever! Failing to schedule recommended treatments in a timely manner could cause you to lose out on hundreds of dollars’ worth of benefits.

It is also worth noting that if you need a major procedure, your dental team might be able to schedule it across calendar years so you can use two maximums instead of only one.

Consider Your Network Status

If you have a PPO dental insurance policy, you can use it to visit virtually any licensed dentist or dental specialist in the U.S. However, only a limited number of practices will be in-network with your plan. Your out-of-pocket obligation may be lower at in-network providers.

Of course, network status is not the most important thing to think about when choosing a dentist. You should prioritize finding a dental team whom you truly trust to care well for your smile.

Know Which Services Are Covered

Most dental plans cover cleanings, exams, fillings, and other common services. However, coverage for advanced or specialty services can vary quite a bit. For example, some plans cover dental implants, while others do not. Coverage for orthodontia can also be vastly different from plan to plan. If you are interested in a specific treatment, you might need to shop around to find an insurance policy that will apply to it.

Navigating dental insurance can be tricky at times! Learn how your policy works so you can use it in a way that benefits both your smile and your budget.

Meet the Practice

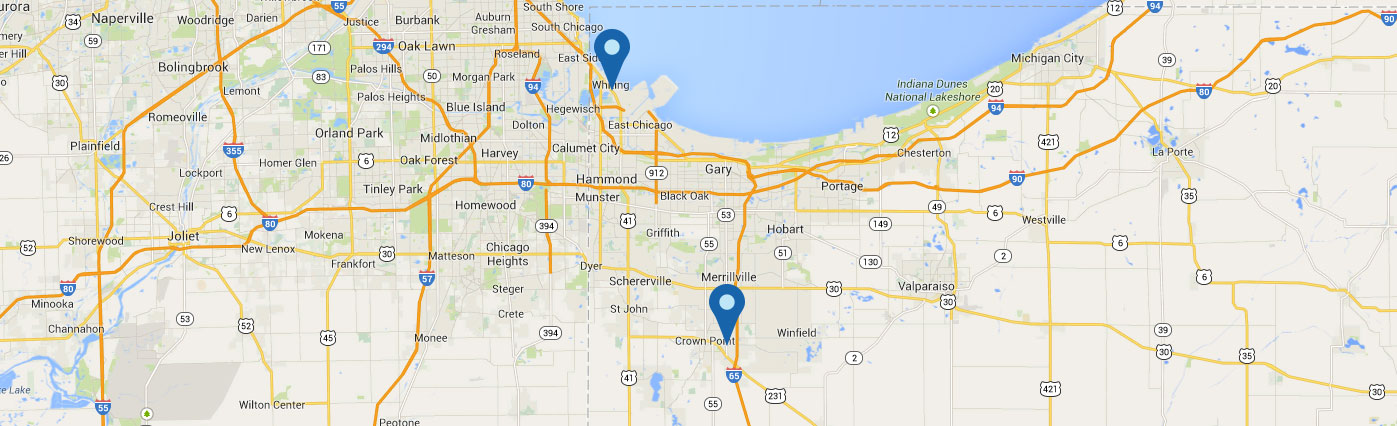

At Berquist Family Dental, Drs. Daniel Jordan Berquist and Robert Jordan Berquist are proud to serve our community. We offer a range of services, and we are happy to help patients file insurance claims. If you have questions about us or our financial policies, we would love to speak with you. Contact us at 219-226-0544.